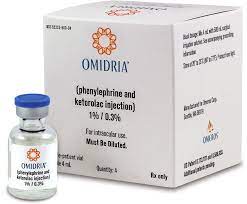

Omeros to Sell Omidria Franchise to Rayner in a Deal Worth More Than $1 Billion

Omeros announced that it has entered into a definitive agreement for the sale of Omidria to Rayner Surgical Group.

The transaction, which is expected to close on or before December 31, 2021, includes an upfront payment of $125 million with an additional $200 million in a commercial milestone payments. Omeros will also retain its accounts receivable balance at the closing, which was $34 million at the end of last quarter. Together with royalties to be paid by Rayner to Omeros on net sales of Omidria, the transaction is valued in excess of $1 billion.

Rayner will pay Omeros royalties on both US and ex-U.S. net sales of Omidria. In the US, the royalty rate will be 50 percent of US net sales until the earlier of either January 1, 2025 or payment of the $200-million commercial milestone, after which Omeros will receive royalties of 30 percent of US net sales for the life of Omidria's US patent estate. The commercial milestone payment is triggered if separate payment for Omidria is secured for a continuous period of at least 4 years. Outside of the US, Omeros will receive a 15 percent royalty rate on Omidria net sales throughout the applicable patent life on a country-by-country basis.

Omidria will become a key product in Rayner’s ophthalmology franchise, which includes IOLs, ophthalmic viscoelastic devices, and dry eye treatments. As part of the agreement, Rayner will acquire the Omidria commercial organization, including the Omidria sales force. In addition, Rayner said it plans to expand the sales force in both the US and ex-US, strengthening its commercial presence internationally and accelerating US market growth of Omidria.

“Omidria will be an important part of our ophthalmic product portfolio internationally and a key strategic focus for Rayner,” Tim Clover, chief executive officer of Rayner, said in a company news release. “Our new Omidria business and commercial team of seasoned industry professionals are an ideal fit for Rayner as we focus on broadly serving ophthalmic surgeons with our pipeline of innovative products, including the recently FDA-approved RayOne EMV intraocular lens. We look forward to continue growing US sales of Omidria and the rest of our portfolio and to launching EMA-approved Omidria throughout Europe and other regions of the world, consistent with our mission of offering superior products and outcomes for surgeons and their patients.”

The transaction is subject to customary closing conditions, including the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

“We are immensely proud of our Omidria team and its achievements over the last 7 years,” said Gregory A. Demopulos, MD, chairman and chief executive officer of Omeros. “Omidria has become an important part of cataract surgery, de-risking the procedure for surgeons and improving patient outcomes. This transaction recognizes both the current and future value that Omidria brings to cataract surgery, affording Omeros a significant ongoing economic interest in the expected growth of Omidria, while allowing us to focus our efforts primarily on our complement franchise of large- and small-molecule MASP-2 and MASP-3 inhibitors as well as on the rest of our innovative pipeline. We believe that Rayner, with its expertise and increasingly strong international presence in ophthalmology, represents a great home for Omidria and the product’s commercial team, and Omeros is committed to assist Rayner, throughout the transition and beyond, to maximize Omidria utilization and revenues.”