Market Scope: Investor Interest in Ophthalmology Remains Strong

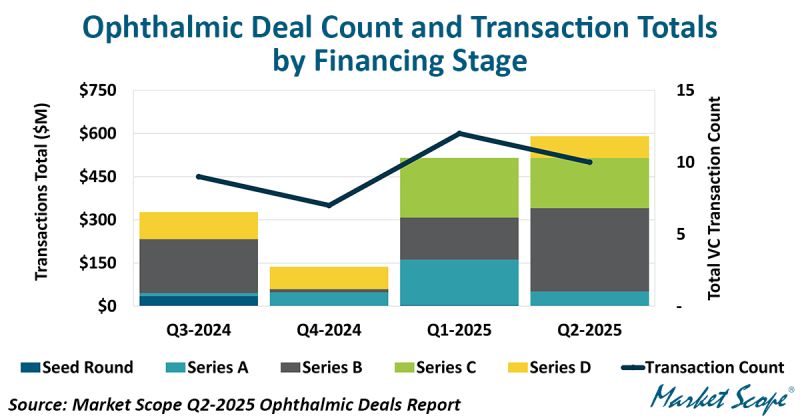

The ophthalmic industry continues to command the attention of investors with $620 million raised across 13 transactions in Q2 2025, according to Market Scope’s latest Ophthalmic Deals Report. However, the investment dollars are down from Q2-2024 and Q1-2025, reflecting a more selective, strategic deployment of capital.

According to Market Scope, the second quarter's deals spanned a broad spectrum—from seed-stage innovation to late-stage commercialization and acquisition:

Early-stage activity led the quarter, with seven rounds raising over $340 million, including nearly $290 million from Series B investments. These rounds predominantly targeted companies with breakthrough technologies and strong potential to reshape therapeutic standards in eye care.

Three late-stage transactions, collectively worth $250 million, focused on companies nearing commercialization or scaling product access.

One acquisition also closed during the quarter, adding to the ongoing trend of consolidation, as established ophthalmic players seek to expand product pipelines and technical capabilities through strategic M&A.

Over the past four years, ophthalmic deal sizes have demonstrated wide variability—ranging from $100K up to nearly $6 billion.

Though total deal volume dipped this quarter, the continued flow of large Series B and commercialization-stage capital suggests strong investor confidence in the long-term fundamentals of the ophthalmic industry.

Market Scope’s quarterly Ophthalmic Deals Reports track and analyze the latest investments across the ophthalmic industry. To access the full report, click here.