In-Office MGD Procedure Market is Largely Untapped, Survey Shows

Doctors in the US and Europe diagnose approximately two-thirds of their dry eye patients with evaporative dry eye but treat very few of them in the office for meibomian gland dysfunction, a primary cause, according to new Market Scope survey data.

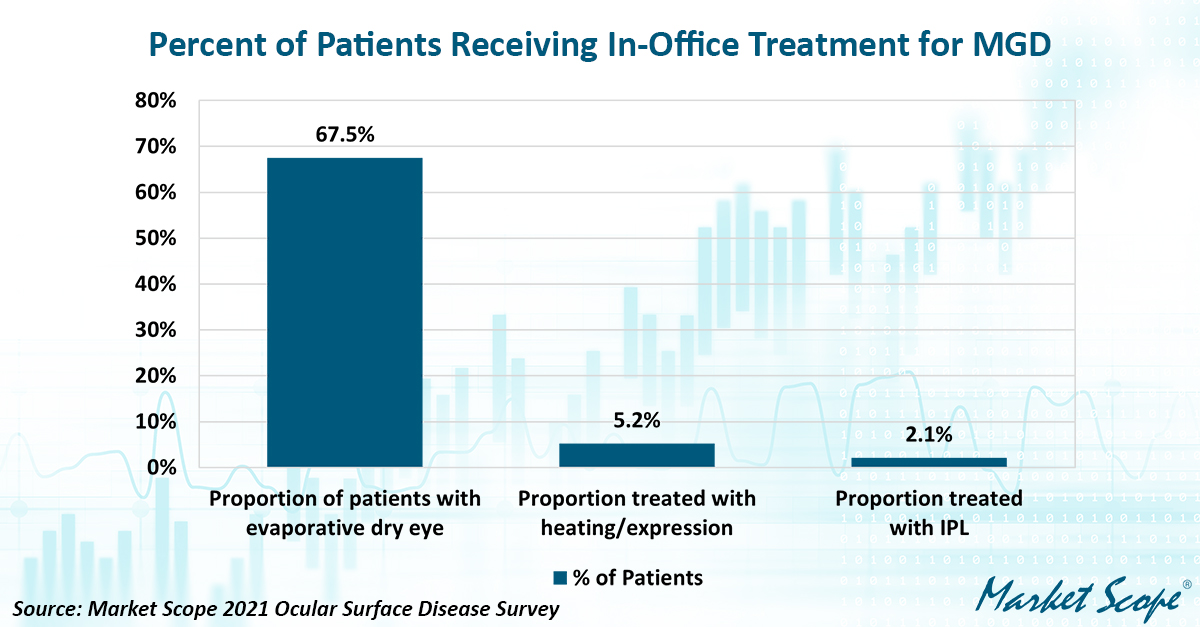

More than 180 eye care practices in the US and Europe participated in Market Scope’s “2021 Ocular Surface Disease Survey.” Doctors diagnosed 67.5 percent of patients as having either evaporative dry eye alone or a combination of evaporative and aqueous-deficient dry eye.

Meibomian gland dysfunction is widely considered the primary cause of evaporative dry eye. Two therapies have demonstrated in clinical trials the ability to improve meibomian gland function and reduce signs and symptoms of dry eye:

—Expressing the glands after warming eyelids to between 40 C and 41.5 C (104 F to 106.7 F).

—Expressing the glands after treating with intense pulsed light (IPL).

Although several thermal expression and IPL devices are marketed in the US and Europe, few dry eye patients receive either therapy, suggesting there still is a lot of untapped potential for market growth. Only 5.2 percent of dry eye patients received thermal expression treatment, and even fewer received IPL treatment.

Although several thermal expression and IPL devices are marketed in the US and Europe, few dry eye patients receive either therapy, suggesting there still is a lot of untapped potential for market growth. Only 5.2 percent of dry eye patients received thermal expression treatment, and even fewer received IPL treatment.

Ocular lubricants remain the most popular treatment by a large margin. Ninety percent of patients use them. Hot compresses without gland expression comprise the second most popular therapeutic segment, followed by lid cleaning and dietary supplements, all used by about one-third of patients.

Topical steroids mostly are used off-label for dry eye, yet they are given to more patients than are cyclosporine and lifitegrast, prescription drugs that are approved for dry eye in some countries. However, doctors often test a dry eye patient’s response to an anti-inflammatory drug with a topical steroid before prescribing cyclosporine or lifitegrast.

Kala Pharmaceuticals launched Eysuvis, the first steroid approved for dry eye, in the US in January 2021. The company has significant market potential if it can convince doctors to switch to an approved ophthalmic steroid from off-label use of a drug not approved for dry eye. Sales started slowly compared with previously approved dry eye drugs Restasis and Xiidra. Eysuvis sales in the first 6 months after launch totaled $3.3 million. In contrast, Restasis hit $22.5 million in its first six months in 2003, and Xiidra reached $40.4 million.

Market Scope’s “2021 Dry Eye Products Market Report” estimates global revenue from lubricants, drugs, and procedures for dry eye at $5.9 billion in 2021 and forecasts the total will grow to $6.7 billion in 2026.

Market Scope’s “2021 Dry Eye Products Market Report,” published in October, has more information on the US and global dry eye markets.