Improved PC-IOL Technology is Key to Recent and Future Premium Cataract Surgery Growth

Presbyopia-correcting IOL technology improvements have led to almost a doubling of global units over the past 5 years and will be critical to driving future growth over the next 5 years, according to a Market Scope report.

In 2022, PC-IOLs will represent nearly 55 percent of premium cataract surgery (PCS) product revenue, or $1.3 billion of the $2.3 billion PCS market.

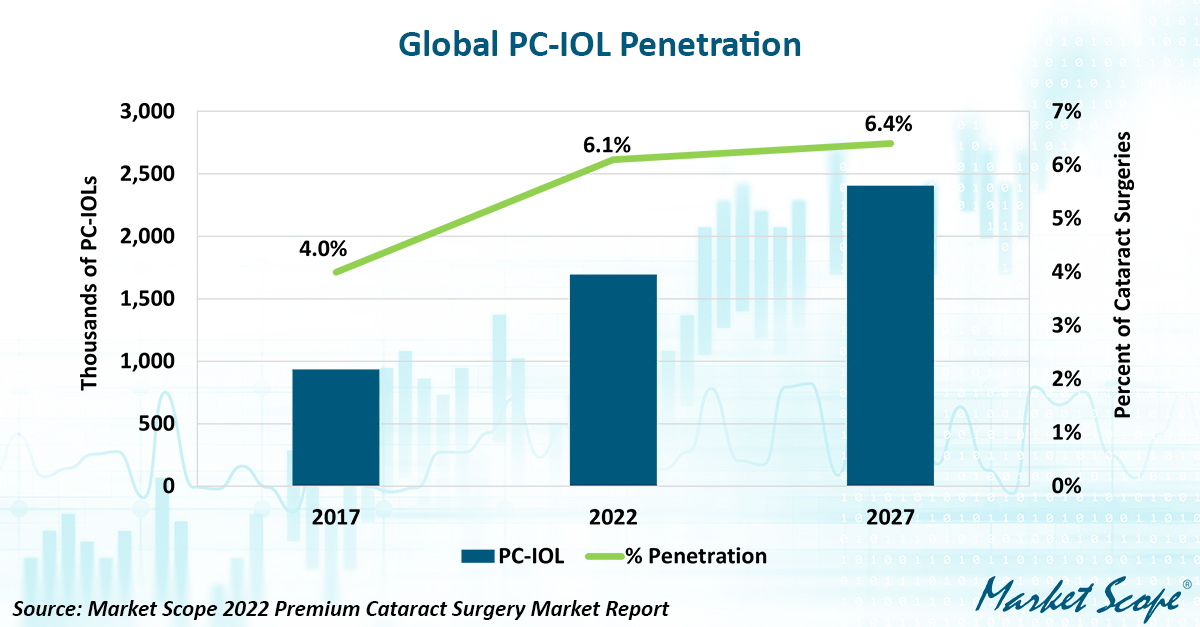

Widespread worldwide adoption of trifocal IOLs and improved extended depth of focus (EDOF) IOLs have led to the surge in the PC-IOL market. The number of PC-IOLs implanted globally has grown from 936 thousand in 2017 to 1.7 million in 2022, with penetration of total cataract and refractive lens exchange (RLE) surgeries growing from 4.0 to 6.1 percent over the same period.

Multiple PC-IOLs offered by mainly US and European IOL companies helped drive the increase in PC-IOL trifocal penetration, which accounted for over half of the world’s PC-IOL units. Leading trifocal competitors include Alcon (PanOptix), BVI (FineVision), Carl Zeiss Meditec (AT LISA), Rayner (RayOne), and VSY Biotechnology (Reviol).

While trifocal IOLs were available in Europe as early as 2015, they did not become widely available in many countries until recently. The Alcon PanOptix, for example, became the first US-approved trifocal in late 2019 and wasn’t widely available until 2020.

In 2021, the PanOptix became the dominant PC-IOL in the US, with an estimated 300 thousand implanted.

A growing number of EDOF IOLs have also been key to the PC-IOL growth. These lenses don’t offer the same degree of spectacle independence as trifocal IOLs, but they reduce the incidence of optical disturbances such as glare and halos. EDOF IOLs are now offered by Alcon (AcrySof Vivity), AcuFocus (IC-8), Bausch + Lomb (LuxSmart), Carl Zeiss Meditec (AT LARA), J&J Vision (TECNIS Symfony and Symfony OptiBlue), and SIFI (Mini Well).

EDOF IOLs are expected to account for about 30 percent of PC-IOLs in 2022, with their share projected to grow over the next few years. Strong growth is occurring in the segment mainly due to the newer non-diffractive EDOF models that have brought fewer complaints of optical disturbances.

Refinements in PC-IOL technology are expected to help increase PC-IOL penetration over the next 5 years. In addition to incremental improvements in EDOF and trifocal IOL technology, the first shape-changing accommodating IOL could be launched within the next 5 years. LensGen appears furthest along, with its Juvene IOL.

Market Scope also anticipate refinements in post-op adjustable IOLs that will enable surgeons to customize EDOF vision in their patients. While the RxSight Light Adjustable Lens (LAL) is not currently approved as a PC-IOL, a growing number of surgeons are using the lens to customize EDOF vision in their bilateral cataract patients.

Projected growth in cataract and RLE surgeries will also be important in increasing PC-IOL volume. Market Scope estimates that the cataract surgery backlog created by the COVID-19 pandemic over nearly 3 years is over 13 million eyes.

The timing of the pandemic bounce-back is difficult to predict, but demand is growing among patients who are losing their sight. Market Scope forecast that the number of cataract and refractive surgeries will grow from 27.7 million in 2022 to 37.8 million by 2027, for a CAGR of 6.4 percent. Revenue generated by PC-IOLs over the same period is projected to grow from nearly $1.3 billion in 2022 to nearly $1.9 billion by 2027.

PC-IOLs are the main driver of PCS revenue today, but other categories—such as toric IOLs, femtosecond laser-assisted cataract surgery (FLACS), manual and FLACS laser corneal incisions to correct astigmatism, LASIK IOL enhancements, post-op adjustable lenses, and intermediate optimized monofocal (also called monofocal plus) IOLs—will also help drive growth over the next 5 years.

In 2022, surgeons will perform nearly 8 million premium cataract surgeries. Market Scope projects that PCS procedures will grow to nearly 13 million by 2027.

Manufacturers’ PCS product revenue in 2022 will exceed $2.3 billion and grow to an estimated $4.4 billion by 2027. Providers of these premium cataract procedures are expected to charge their patients over $14.1 billion in 2022, growing to nearly $27.0 billion by 2027.

Eighty-four percent of manufacturers’ PCS revenue in 2022 comes from 13 countries. Ranked by 2022 PCS revenue, they are: the US ($961 million); China ($197 million); South Korea ($155 million); Japan ($123 million); Brazil ($82 million); Germany ($78 million); Canada ($72 million); Australia ($66 million); France ($53 million); India ($52 million); Spain ($51 million); United Kingdom ($32 million); and Italy ($28 million).

Market Scope’s “2022 Premium Cataract Surgery Market Report” was published in November.