Market Scope: Improved Vitrectomy Machine Features Expected to Expand Retinal Treatments

Advancements in vitrectomy machine technology are expected to improve safety and efficacy and enable surgeons to reach a larger population of patients with retinal disease over the next 5 years, according to a Market Scope report. These advancements include small-incision vitrectomy, subretinal treatment capability, machine-integrated 3D visualization, intraoperative OCT, robotic technology, and office-based surgery.

Smaller-gauge vitrectomy instruments developed and improved over the past decade have increased the safety and effectiveness of surgery, including shortening patient rehabilitation, and we expect this trend to continue.

Vitrectomy instruments have moved from 23 gauge to 25 gauge and even 27 gauge. We look for continued improvements in 27-gauge instruments over the next 5 years, enabling surgeons to perform safer vitrectomies.

3D digital visualization systems are integrated with vitrectomy machine functions and increasingly becoming an essential tool for the surgeon.

They provide superior visibility of the surgical site and enable the surgeon to access machine function information in one place and expand surgical team collaboration through a shared heads-up view.

They also allow the surgeon to customize an individual patient’s image profile for greater efficiency and enhanced visualization.

The Ngenuity 3D Visualization System (Alcon) consists of a 3D stereoscopic, high-definition digital video camera and workstation to provide magnified stereoscopic images of objects during microsurgery. It acts as an adjunct to the surgical microscope during surgery, displaying real-time images.

At retina meetings in 2022, much of the surgery-related conversation was about the future of subretinal gene therapy injections and the implications for next-generation vitrectomy machines. Retina specialists focused on the challenges experienced in recent gene therapy clinical trials, but most surgeons expected gene therapy for inherited retinal disease to eventually become a reality, partly because of the technology developed by the vitrectomy machine leaders.

Panelists at one meeting said one factor critical to the success of subretinal gene therapy would be the capability of vitrectomy machines to precisely position and dose the injections. Accomplishing this will require significant innovation, including robotic technologies and integrated real-time OCT.

Intraoperative OCT is a technology that retina specialists have found somewhat useful, but the cost has prohibited it from becoming widely available. No specific indications for intraoperative OCT have driven its adoption. Subretinal gene therapy is expected to require precise placement relative to anatomical markers that can be adequately visualized only with use of intraoperative OCT, according to Market Scope.

Many see real-time OCT integrated with vitrectomy machines as a necessity to help drive the development of ophthalmic gene therapy.

Robotic retinal surgery also was a topic much debated at retina meetings in 2022. There is significant disagreement among retina surgeons and industry executives over the extent, implementation, and timing of robotic surgery, but there is agreement that it is coming.

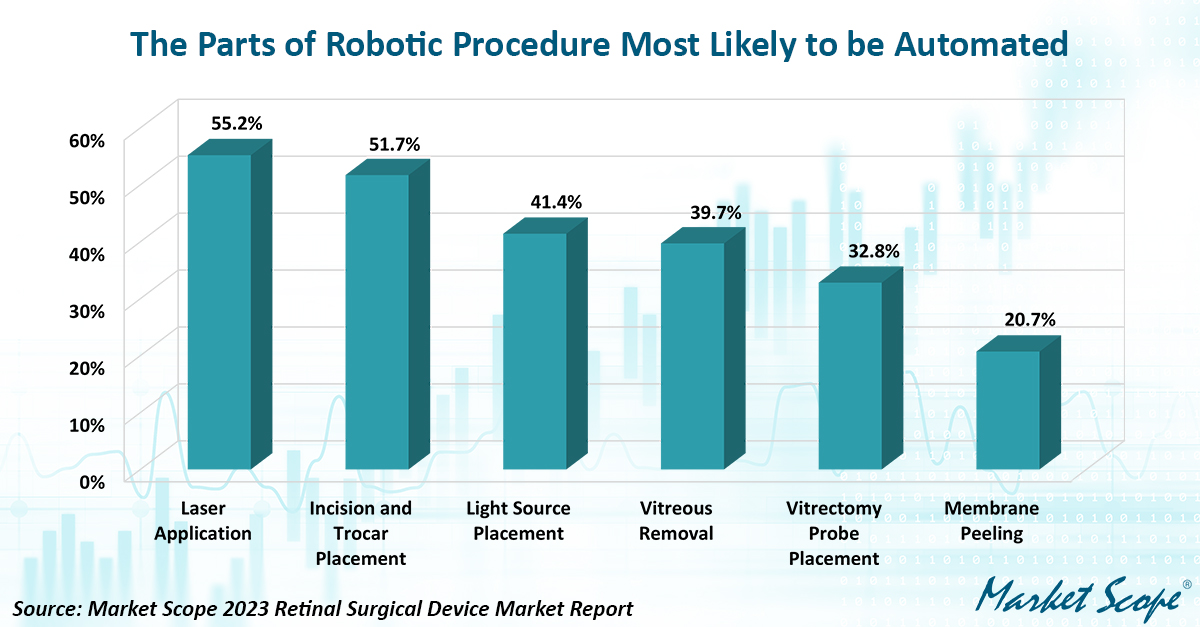

Market Scope’s Q4-2022 US Ophthalmologist Survey asked respondents who perform retinal surgery what parts of robotic surgery were most likely to be automated. As illustrated in the chart below, the most frequently listed procedure phases were laser application, incision and trocar placement, and light source placement.

Other trends that could change the way retinal surgery is performed include office-based surgery. Cataract surgery is already being performed in the office in the US.

Tarek Hassan, MD, discussed office-based vitrectomy surgery in a session at the 2022 American Academy of Ophthalmology meeting. Overcoming the current lack of reimbursement and industry commitment to invest in development are the keys to office-based surgery going forward, Dr. Hassan said.

Market Scope’s “2023 Retinal Surgical Device Market Report” discusses these and other expected surgical enhancements that will help drive demand for vitrectomy machines, surgical packs, and adjunctive devices, such as cryosurgical devices, light source consoles and illuminator probes, silicone oil, perfluorocarbon, ocular gases, scleral buckles, and ocular dyes.

Market Scope forecasts an estimated 2 million vitrectomies will be performed globally in 2023, and we project the total will grow to 2.3 million by 2028.

We look for vitrectomy machines, dedicated machine packs, accessories, and allied surgical products to total $1.28 billion in 2023 and to grow to $1.58 billion by 2028, for a CAGR of 4.4 percent.

Market Scope’s “2023 Retinal Surgical Device Market Report” was published in March.