Market Scope: Global Refractive Market Rebounds Strongly After COVID-19

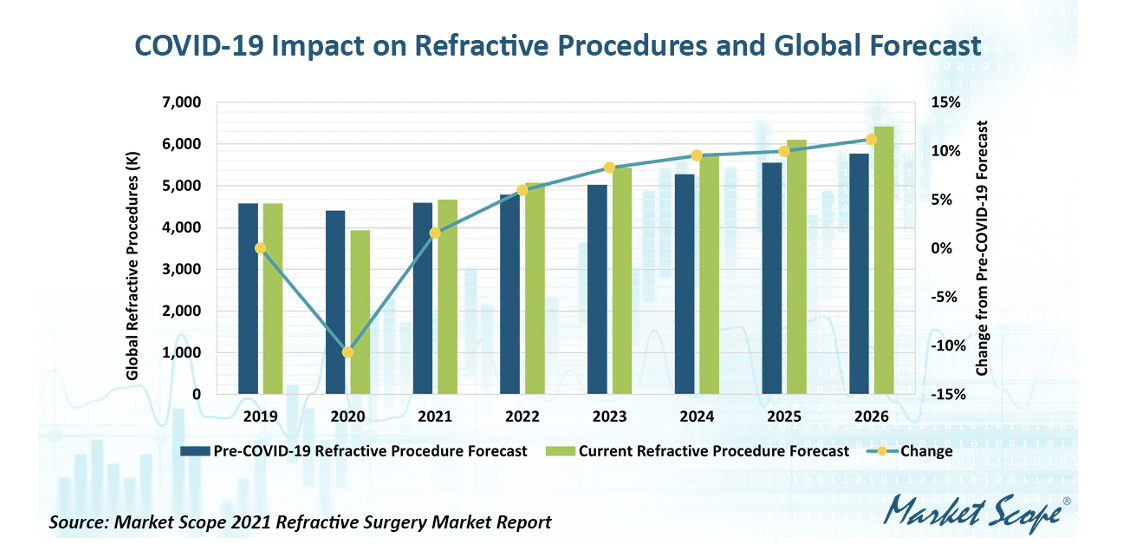

The impact of COVID-19 shutdowns initially sharply reduced the number of refractive surgical procedures, but demand has bounced back strongly, with the use of protective masks initiating new drivers for the market, according to a Market Scope report.

Add to that the emergence of topical drops to correct presbyopia, Market Scope estimates that if just 1 percent of the serviceable presbyopia market is captured with pharmacological approaches, the refractive market could grow by over $300 million annually.

Market Scope looks at the latest trends in the refractive segment in its new “2021 Refractive Surgery Market Report.”

Global demand for refractive surgery (laser vision correction, presbyopia-correcting surgery, refractive lens exchange, and phakic IOL implantation) is expected to grow at a compound annual rate of 6.6 percent from 2021 to 2026, with annual volume increasing nearly 4 million to over 6 million procedures.

Laser vision correction procedure volume has remained relatively flat since 2007, with the exception of a dip in 2008 and 2009 due to economic conditions and financial fallout in major markets, and a drop in 2020 globally due to COVID-19.

Factors driving significant growth are phakic IOLs and lenticule extraction procedures.

Market Scope forecasts that the global refractive surgery industry will generate $12 billion in total retail revenue in 2026—up from $8.5 billion in 2021—for a compound growth rate of 7.1 percent. The firm expects revenue at the manufacturer level to grow from $1.6 billion in 2021 to $2.3 billion in 2026, for a compound growth rate of 7.7 percent.

The United States, China, and South Korea are the highest grossing refractive markets, and Market Scope expects China to claim the top spot by 2024.

Market Scope estimates several countries’ revenue growth to outpace the overall refractive market’s CAGR of 7.7 percent—including Vietnam, Hong Kong, Malaysia, and Saudi Arabia.

The firm expects 22 countries to have markets exceeding $10 million in manufacturer revenue in 2021, with the total growing to 26 countries by 2026.

The presbyopic market has been historically difficult to penetrate with current technologies; it is likely, though, that the barrier for adoption will be significantly reduced with topical drops versus surgical approaches.

Allergan’s Vuity (pilocarpine HCl ophthalmic solution) 1.25% was approved by the FDA in October for the treatment of presbyopia in adults. Vuity is alone in the market for now, but competitors are on the way, with several companies developing presbyopia drops that are currently in Phase III and Phase II clinical trials.

As more presbyopia treatments, particularly pharmacological approaches, become a reality, it is important to understand the population that can benefit from these products.

Many presbyopes throughout the world lack access to ophthalmic care. Further, many people within the presbyopic population who have access to care do not have the discretionary income for cash pay treatments. The new report present the total available market (all presbyopes), total addressable market (presbyopes with access to ophthalmic care), and total serviceable market (presbyopes with access to ophthalmic care able to afford cash pay treatments).

The 415.6 million people in the serviceable market are disproportionally located in wealthy nations. Nearly 28 percent of the serviceable market resides in Western Europe, and 24 percent reside in the United Sates. Market Scope estimates 28.1 million people will be added to the serviceable market by 2026.

Market Scope’s “2021 Refractive Surgery Surgery Market Report,” was published in December.