Market Scope: Factors Driving Retinal Pharma Pipelines are Injection Interval, Safety, and Price

Longer injection intervals without gene therapy might be the theme for retinal pharmaceuticals in 2021, thanks to subsidiaries of the Roche Group filing marketing applications in the US and Europe for the Lucentis Port Delivery System and marketing applications for faricimab in Europe, Japan, and the US.

Genentech/Roche is aiming for a 6-month treatment interval with the Port Delivery System. Chugai Pharmaceutical Co./Roche is targeting a 4-month treatment interval with faricimab. Genentech expects to receive a decision from the FDA by Oct. 23.

These new products will take aim at market leader Eylea, the dominant retinal pharmaceutical, with 60.1 % of market revenue in 2020 on a 26.2% unit share.

Eylea, Lucentis, Avastin, Beovu, and Lumitin all are inhibitors of vascular endothelial growth factor (anti-VEGFs), the most effective class of drugs for macular edema. They are administered by injection into the vitreous cavity of the eye.

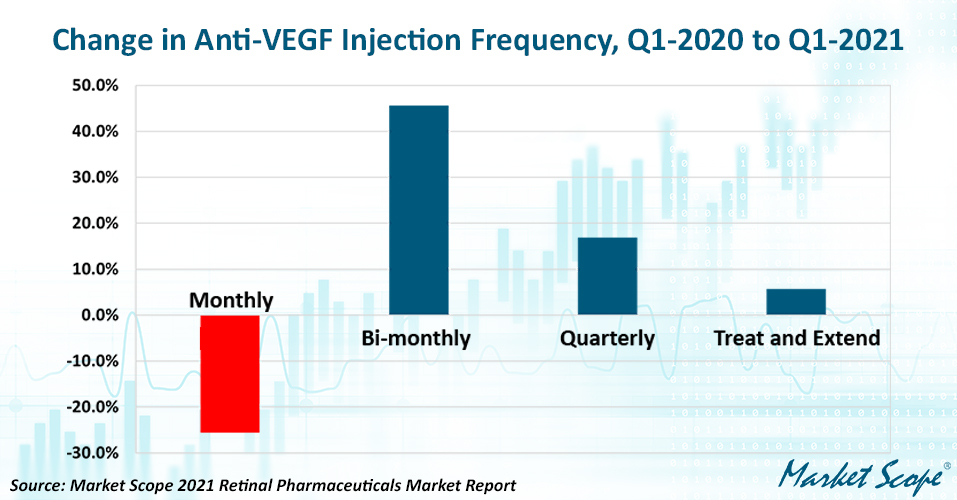

There was a marked change in anti-VEGF injection intervals in the US after the beginning of the COVID-19 pandemic. The fraction of patients on a fixed monthly injection schedule fell by 5.4 percentage points in 2020, a 25.6% drop, while the fraction of patients on a fixed bi-monthly schedule grew by a similar 5.3 percentage points for a 45.6% gain. The fraction of patients on a flexible treat-and-extend schedule also trended upward, from 49.6% to 52.5%.

The Port Delivery System and faricimab will give retina specialists additional tools to address concerns about infectious disease and injection burden by offering the possibility of fewer office visits and fewer injections. Safety, however, is key. If the new approaches cannot offer longer treatment intervals without compromising safety, they will face limited prospects for success.

The advancement of the Port Delivery System and faricimab to the regulatory approval stage is a big deal. Retina is an active area for drug development––Market Scope is tracking 460 drug development programs targeting a disease in retina––but a difficult one. Failures are common. Two leading gene therapy programs at Biogen, cororetigene toliparvovec for X-linked retinitis pigmentosa and timrepigene emparvoved for choroideremia, failed to reach preset endpoints in late-stage clinical trials ending in 2021. The global phase 3 trials for conbercept (Lumitin, Kanghong Biotech), an anti-VEGF approved in China, were halted because too many patients dropped out.

Safety concerns affected sales of an approved gene therapy, Luxturna, in 2020 and caused Adverum to stop developing another gene therapy, ADVM-022, for diabetic macular edema in 2021. Safety problems with ADVM-022 in DME became apparent in a phase 2 trial. Safety issues likewise prompted Novartis in 2021 to suspend a phase 3 program to extend the labeling for anti-VEGF brolucizumab (Beovu) to retinal vein occlusion.

While Roche subsidiaries expended great effort to develop new technologies for treating retinal disease, many companies are focusing on reducing the cost of treatment by bringing biosimilars of established anti-VEGFs to market. Regulators in the US and Europe approved Biogen’s biosimilar for Lucentis (ranibizumab) in the third quarter of this and Japanese regulators are considering an application for a ranibizumab biosimilar from Senju. Coherus, Teva, and Bausch + Lomb are expected to file for approval to market additional ranibizumab biosimilars.

Smaller companies, such as Outlook Therapeutics and Essex Bio-Technology, will be seeking approvals to market biosimilars of bevacizumab for treating exudative retinal disease. Outlook Therapeutics finished dosing patients in its US phase 3 clinical trial in June 2021. Essex and development partner Shanghai Henlius Biotech dosed the first patient in their global phase 1 clinical trial in July 2021.

The US price of intravitreal Lucentis began falling even before the introduction of biosimilars. The average Medicare price for a 0.5 mg dose stood at $1,535 in July 2021, compared with $1,932 in 2016. Market Scope expects the price to fall further once there is biosimilar competition on the market.

Market Scope looks for a price on the first biosimilar of 80 to 85 percent of the Lucentis price, with subsequent competitors exerting downward pressure on prices until the average sales price of biosimilars settles somewhere between 40 and 60 percent of the pre-biosimilar launch of Lucentis. We expect the prices of ophthalmic bevacizumab products to settle in the space between the price of compounded, off-label bevacizumab and the lower-priced Lucentis biosimilars.

Market Scope’s “2021 Retinal Pharmaceuticals Market Report” forecasts that biosimilars, including ophthalmic bevacizumab products, will account for 10.5% of global retinal drug units by 2026 and $1.6 billion in sales.

The report contains additional forecasts for the global retinal pharmaceuticals market and more information about product candidates in development pipelines

Market Scope’s “2021 Retinal Pharmaceuticals Market Report” was published in August.